Crocs is an extremely well recognized brand globally. The clog originated as a product with a practical use case that was for a shoe that works both on land and in water (hence the name Crocs) and the company was founded in the early 2000s.

In 2014, Blackstone invested in Crocs through a PIPE deal and simultaneously brought a number of key executives on board. The redeemable shares that were issued to Blackstone have since been redeemed, so the only remaining equity is common shares.

The turnaround in the Crocs business is quite clear from historic financials: The margins improved, production was entirely outsourced, distribution was better controlled and working capital requirements were reduced quite substantially. The brand was repositioned as a trendy, luxury leisure brand whereas it was previously the sort of thing you bought at the petrol station.

Today Crocs has outrageously strong gross margins in the 50%+ range and generates a lot of free cash flow, reflecting the repositioning of the brand and its popularity among consumers. The Jibbitz Charms that Crocs sells alongside its clogs lean heavily into the self-expression and personalization that is the new normal for today’s consumer. It’s no secret that they also are enormously profitable.

Collaborations have turned the heat up on the Crocs brand where multiple huge brands, designers, artists, and everything in between wants a piece of the action. These limited edition runs have been selling out in minutes, and have a somewhat cult-like following. The margins are, of course, amazing on these collabs and them selling out rapidly certainly helps inventory management too. Some of the limited edition runs are selling in the aftermarket at multiples of the original retail price, illustrating the rise of Crocs to a level akin to Nike when it drops Air Jordans or whatever else.

The fly in the ointment for Crocs has largely been HeyDude; Crocs acquired the business in 2021 paying 20 times earnings, which might be explained by the following

- Crocs management likely felt fear regarding the narrow scope of the business, dealing only in foam clog products

- HeyDude was growing at a triple digit clip and

- The HeyDude brand kinda fit in with the casual leisure vibe that Crocs had cultivated for itself.

While the (substantial) debt related to the acquisition has been paid down to levels that management is comfortable with, HeyDude has seen negative growth for the last few quarters (and in the negative double digit %s at that) resulting in a pretty strong selloff in the CROX stock. The slower growth of the Crocs brand compared with the previous few years has also contributed to the selloff bringing the price down to ~$100.

I would argue that the stock is a buy here under $110 for several reasons.

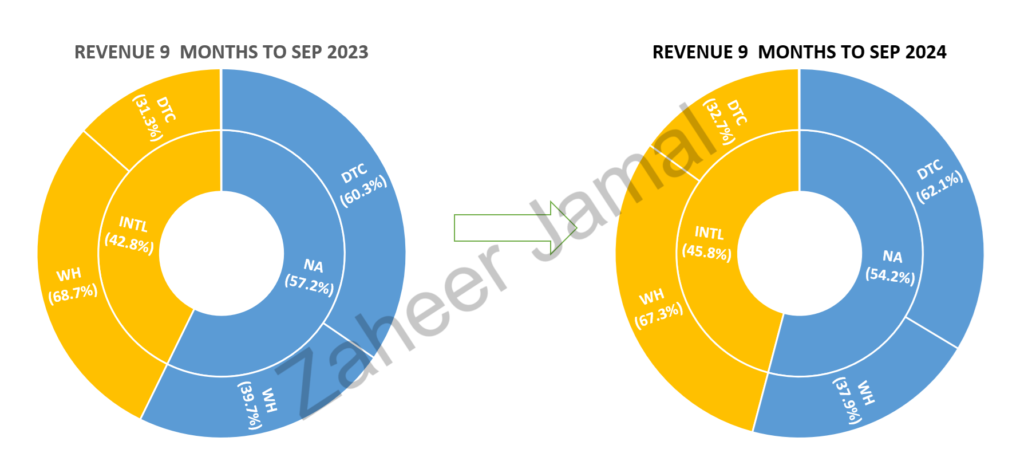

First, let’s have a look at revenues for the 9 months ending September 2023 vs 2024 specifically for the Crocs brand:

While the North American (NA) market has been the stronghold of the Crocs brand, the International segment has been growing at a decent clip (17% QoQ in Q3 ’24) and still makes up less than half of the revenue for the brand. The Direct To Consumer (DTC) segment both in NA and internationally has been growing a bit faster than has the wholesale(WH) segment. While revenue growth as a whole has slowed, it is not declining.

Second, the runway for growth in the international markets is exceptionally long; China, India and Korea are likely candidates for success, while management also includes Japan and Western Europe as “tier 1” targets for growth. Japanese culture, in my view, probably doesn’t mesh too well with the Crocs image and I would suspect China, India, and Korea present the best opportunity.

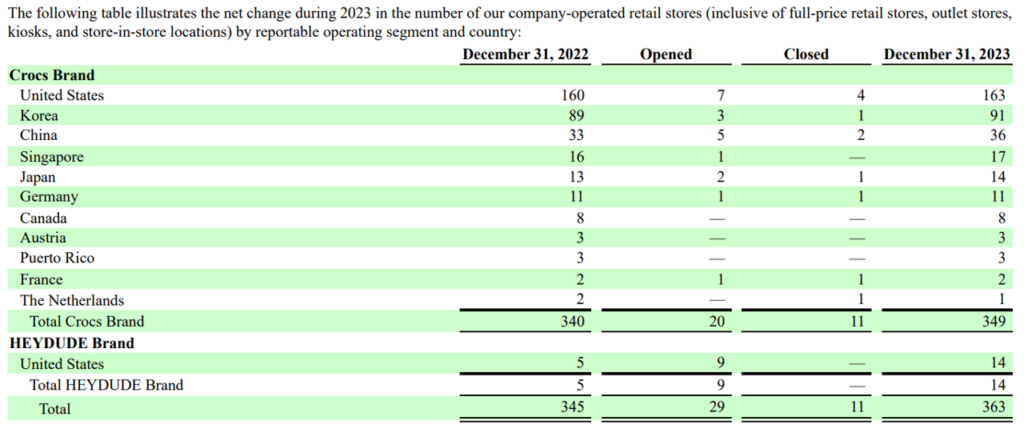

Revenue isn’t disclosed by geography specifically, but you can look at store count as a proxy + from earnings calls and some investor presentations slides one can pick up that revenues out of China grew 90% in the 2023 period and for example still grew a healthy circa 20% in Q3 ’24. India has presented some regulatory trouble for Crocs which has resulted in them needing to begin producing product inside of India, which they have done but expect to be running at full tilt only in 2025.

Collaborations with K-Pop stars have begun in Korea and given the quality of the marketing team at Crocs, I’d argue that they stand a good chance of success. Given success in even 1 of the “tier 1” targets would mean we’re off to the races.

HeyDude is the elephant in the room and perhaps should get a post all on its own. Suffice it to say that management is aware that things aren’t going according to plan with the brand and are actively trying to address this. Terrence Reilly who can be credited with much of the success of the Crocs marketing since 2015 is back and in charge of HeyDude, after leaving for Stanley in 2020. He casually took Stanley (a 100+ year old brand) from ~$70m to >$700m in revenue through his marketing genius. I’d not bet against him at HeyDude. He’s brough Sydney Sweeney onboard as “Director of Dudes” as he believes that youth female culture shapes culture as a whole. Other marketing shifts abound; the move from performance to brand marketing, the opening of the HeyDude TikTok shop (already generating massive heat) and other moves from the team seem promising. I would add the caveat that I think HeyDude shoes lack a fundamental x-factor but again, I would not bet against Reilly.

The increased marketing spend on HeyDude will show up as an increase in SG&A and whether shareholders see a return on that investment requires a gander into a crystal ball, which I unfortunately don’t have.

Third I’d point to brand loyalty, quality of marketing team, returns on invested capital and both absolute and relative value.

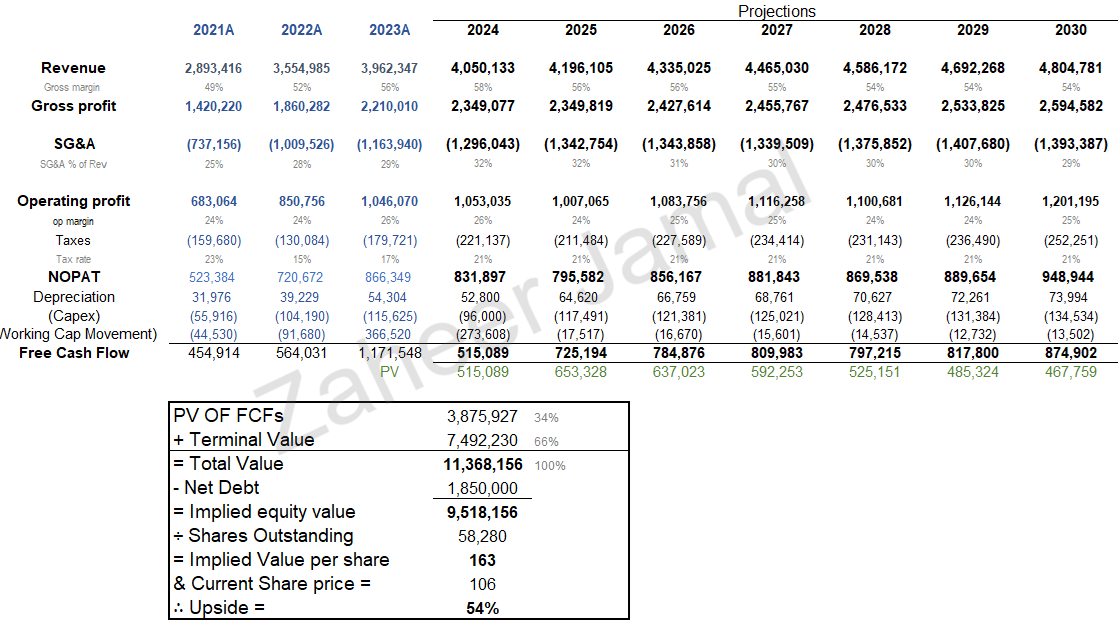

Overall then, the situation looks something like this to me:

Assumptions in the above DCF are:

- Low single-digits growth

- 21% tax

- 11% discount rate

- 13x multiple on terminal FCF

Just for context, here are some comparison statistics:

Cheap, right? The major concerns I consider worth keeping an eye on are:

- Management not cutting losses on HeyDude if it comes down to it

- A further diworsifcation acquisition

- True change in consumer preferences

But overall, I’ve loaded up (bought a nice tranch under $100) and am pretty darn bullish (if that wasn’t abundantly clear.)

For an overview of the business performance, I suggest referring to https://www.roic.ai/quote/CROX/classic

Leave a Reply